Mumbai (Maharashtra) [India], September 9 (ANI): Indian markets started the fresh week with a decline following weak global cues and a downturn in Asian markets.

Globally, markets are under pressure as the Fed meeting date approaches and due to the slowdown in growth in Germany and the Chinese economy.

The Nifty 50 index on the National Stock Exchange opened negative with a decline of 28 points or 0.12 per cent at 24,823 points, while the BSE Sensex opened at 80,973.75, down by 210 points or 0.26 per cent.

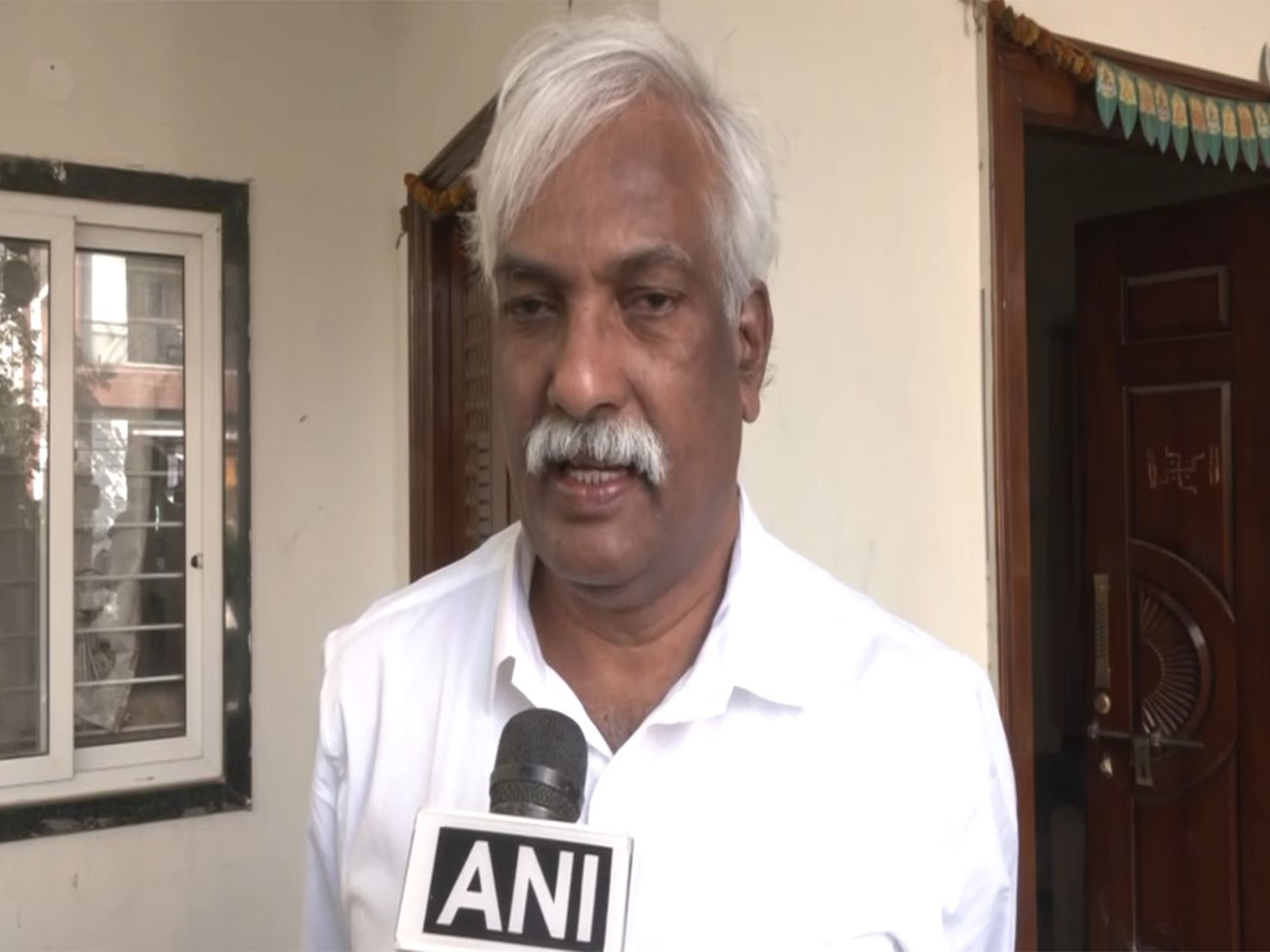

“Eight days of volatility are assured for the markets as the Fed rate cut of Sep 18th comes within striking distance. The seasonality of poor September performance of markets is playing out as per expectations. On top of that, the slowdown in China and Germany is adding to global growth worries. The news of a top German car manufacturer mulling closing down car factories in Germany was symbolic of all that is troubling Germany,” said Ajay Bagga, Banking and Market expert, to ANI.

In the broad market indices on the National Stock Exchange, all major indices except Nifty MicroCap 250 opened in the negative.

In the sectoral indices, Nifty FMCG, Nifty Media, and Nifty PSU Bank gained, while the other indices declined. However, experts also noted that the impact of the other Asian markets will be less on Indian stocks amid the support by the domestic investors, Bagga added, “For Indian markets, the impact is coming via FII selling. The good news is that despite the net FII outflows of over Rs 5.5 lakh crore from Jan 2022 to August 2024, the Rs 11 lakh crore plus of robust domestic inflows have meant every dip has been bought into in the Indian markets. We expect a couple of weeks of this volatility, but don’t expect sharp cuts in the Indian markets given the domestic liquidity sitting on the sidelines.”

Asian stock markets also plummeted on Monday as selling pressure mounted after lower-than-expected US payroll growth.

The Japanese and Hong Kong markets faced high selling pressure, with major indices declining by more than 1.50 per cent. Japan’s Nikkei 225 index declined by 1.84 per cent or 632 points, while Hong Kong’s Hang Seng was down by 1.73 per cent or 301 points at the time of filing this report.

Taiwan’s markets also bled, with the country’s major index, Taiwan Weighted, declining by more than 2 per cent. South Korea’s KOSPI index plummeted by 1.15 per cent.

Overall, a selling sentiment was witnessed among investors in the Asian markets. According to experts, concerns of a slowdown in China and Germany have added fuel to the selling in stocks, which were already volatile due to Fed rate cut expectations.

Indian stock indices took a sharp hit on Friday, the last trading day of the current week, with all sectoral indices closing deep in the red. The sell-off was broad-based, with the banking and energy sectors taking the biggest hit.

Nifty 50 dropped 292.95 points, or 1.17 per cent, to 24,852.15, while the BSE Sensex fell 1,017.23 points, or 1.24 per cent, to 81,183.93 (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages